We’re diving deep into a popular and effective strategy – the London Breakout Strategy – specifically adapted for the 1-hour (1H) timeframe. This isn’t a brand-new invention, but a refined approach based on a time-tested method, tweaked for maximum consistency and efficiency. We’ve seen positive results, and we’re excited to share it with you!

What is the London Breakout?

The London Breakout strategy capitalizes on the increased volatility that often occurs when the London trading session begins (typically around 8:00 AM GMT). The intersection of the Asian and European trading sessions often creates a period of price movement as London traders enter the arena. This leads to breakout opportunities that can be profitable if properly identified and traded.

Why the 1H Timeframe?

Many Forex Trader have found the 1H timeframe to be the sweet spot for this strategy. It offers a reasonable balance between capturing significant breakout movements and minimizing false signals. It lets you get in and out with enough time to not constantly monitor the trade.

The Strategy – Step-by-Step

Here’s how to implement this refined London Breakout Strategy:

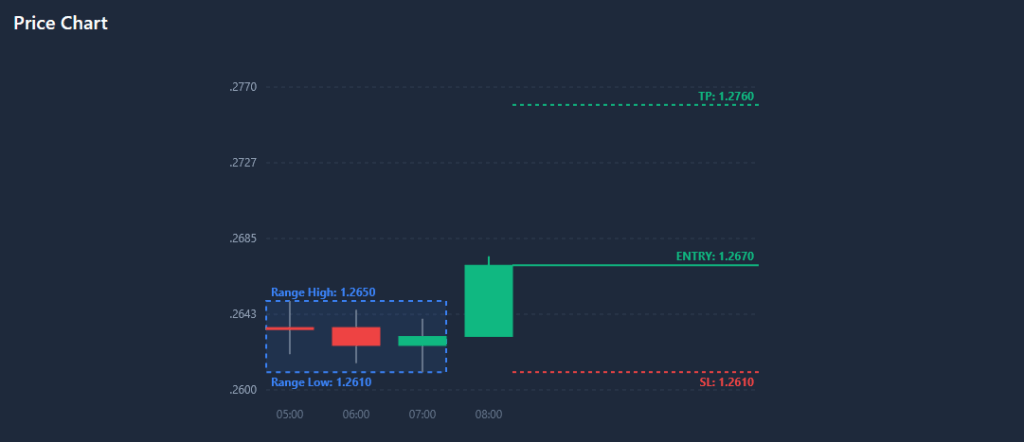

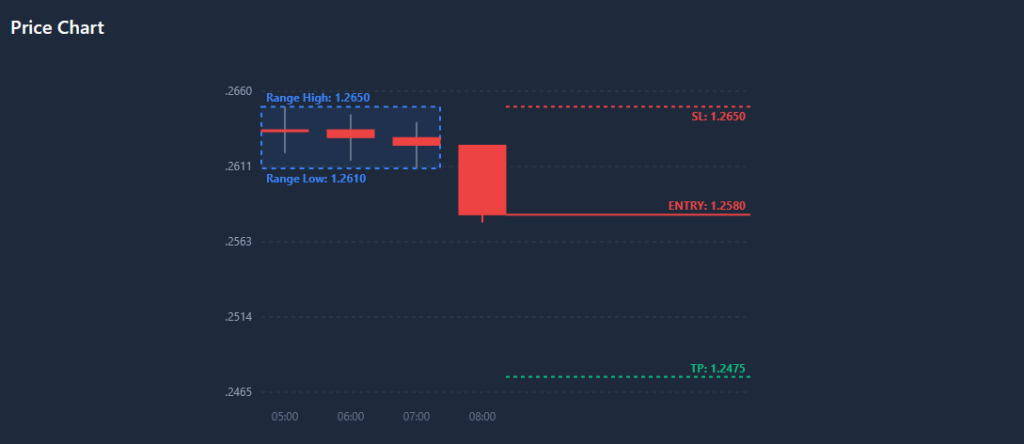

- Identify the Range: Plot the high and low of the last three (3) candlesticks before the London market opens. Use lines or a rectangle box to visually outline this range on your chart. (See examples below).

- Wait for the Breakout: Once the London market has opened, patiently wait for the price to break either above the high or below the low of the identified range.

- Enter the Trade: Crucially, only enter a trade when the breakout candle has closed beyond the range. This confirms the breakout’s validity.

- Set Your Stop Loss (SL): Place your stop loss on the opposite end of the range. If you’re going long (buying), set your SL just below the range low. If you’re going short (selling), set your SL just above the range high.

- Target Your Profit (TP): Aim for a 1.5 Risk-to-Reward ratio (1.5 R:R). This means if you risk $10, aim to profit $50.

- Risk Management: Risk only 1-2% of your total account balance per trade.

- Monitor and Close (or Forget!): Ideally close trades if it hits SL or TP. If those conditions aren’t met, monitor the trade until the US market close.

Currency Pairs to Consider:

We recommend trade the following currency pairs:

- EURGBP

- EURUSD

- GBPJPY

- GBPUSD

- USDCHF

- USDJPY

Real-World Examples

Pro Tip

Always Monitor the Candlestick Close Price

BUY Scenario

Sell Scenario

Important Considerations:

- Backtesting and Demo Trading: Before risking real capital, thoroughly backtest and demo trade this strategy to ensure it aligns with your trading style and risk tolerance.

- No Strategy is 100%: Understand that no Forex strategy guarantees 100% success. A 1.5:1 Risk-to-Reward ratio allows for a 50% win rate while still generating a consistent positive return.

- Adapt and Refine: This is our adapted approach. Feel free to experiment and refine the strategy to suit your preferences.

Resources to Boost Your Trading:

- Forex Market Session Hours: Check our web based Forex Market Hours Session tool – Know exactly when each major trading session opens and closes.

- MetaTrader 5 Session Indicator: Download– Visualize session boundaries directly on your MT5 charts.

Disclaimer: Forex trading involves significant risk. This article is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making any trading decisions.